Zero tax rate Germany

Zero tax rate for photovoltaic systems (Germany)

Since January 1, 2023, a VAT rate of 0% applies in Germany to certain photovoltaic supplies and services. This tax measure is intended to further promote the expansion of renewable energies and was introduced as part of the 2022 Annual Tax Act.

For whom does the zero tax rate apply?

The application of the zero tax rate is subject to the following conditions:

- The plant location, as well as the billing and delivery address, must be in Germany.

- Delivery is made to the operator of the photovoltaic system (not to dealers or resellers).

- The photovoltaic system is erected on or near private residences, residential buildings or buildings that serve the common good .

- According to the market master data register, the installed gross capacity of the plant is a maximum of 30 kWp or will not exceed this value.

Commercial customers such as retailers, resellers, or installation companies will continue to receive an invoice with 19% VAT . This can be claimed as input tax , as usual.

Which products are eligible for the discount?

The zero tax rate applies to:

- Solar panels

- inverter

- Battery storage

- Mounting systems / roof brackets

- Solar cable and connection material

- Energy management systems

- Wieland power inlet sockets

- Backup solutions and emergency power systems

- Radio ripple control receiver

The following services are also eligible for preferential treatment:

- The installation of photovoltaic systems and battery storage systems, provided that the supplied components meet the requirements.

- The intra-Community acquisition and import of such equipment and components.

How is the zero tax rate implemented in practice?

When placing an order through Voltaik Holzner GmbH, you confirm during the ordering process that you meet the requirements according to § 12 para. 3 UStG .

Should any discrepancies arise subsequently (e.g., incorrect information regarding the operator's status), the invoice will be adjusted retroactively and the regular VAT rate will be charged.

Frequently Asked Questions (FAQ)

What is the difference between sales tax and value added tax?

Both terms refer to the same tax. "Sales tax" is the official tax law term, while "value-added tax" is the more common term in everyday language.

Does the zero tax rate also apply to balcony power plants?

Yes, provided they are stationary mini-PV systems installed on or near residential buildings. Mobile solar panels, e.g., for camping purposes, are not eligible.

What about maintenance contracts or repairs?

Maintenance and warranty contracts as well as pure repair services (without replacement of components) remain subject to the regular VAT rate of 19%.

However, the replacement of defective parts in connection with delivery and installation falls under the 0% rule.

What happens if a system that has already been ordered is not delivered until 2023?

The decisive factor is the date of delivery or installation . If this is after December 31, 2022, the zero tax rate applies.

Can I still claim input tax credits when the zero tax rate is applied?

No. Since no VAT is charged, no input tax deduction is possible. This makes opting out of the small business regulation unnecessary in many cases.

Legal basis :

Section 12 Paragraph 3 of the German VAT Act (excerpt):

The tax is reduced to 0 percent for the supply and installation of solar modules, including essential components and storage systems, provided the photovoltaic system is installed on or near private residences or buildings serving the public good. This regulation is considered fulfilled for an installed capacity of up to 30 kWp.

Formular ausfüllen, wir melden uns!

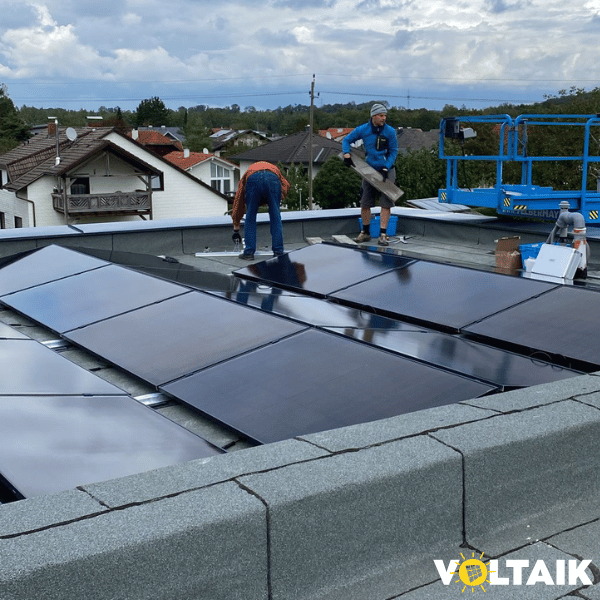

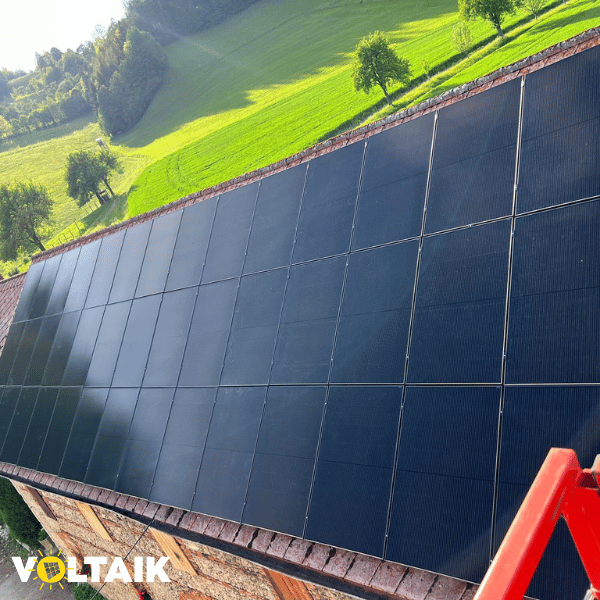

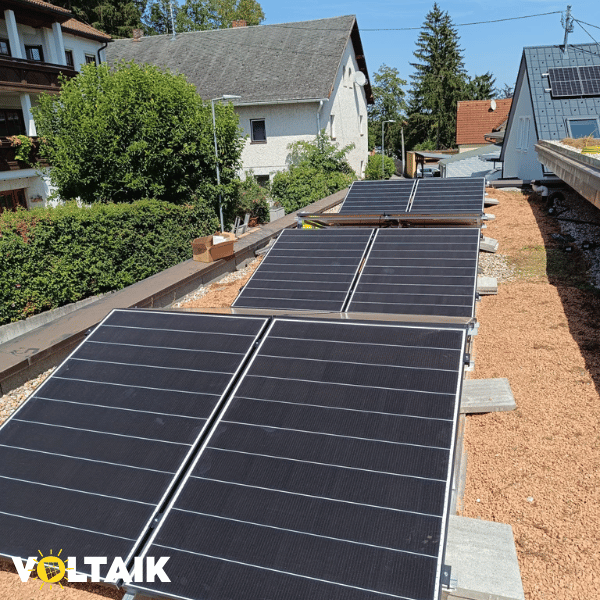

Schnelle Montage & Installation gesucht?

✅ Kostenloste Kontaktaufnahme.

✅ Angaben werden NICHTweitergeleitet.

✅ Wir montieren selbst.